Apple Pay is now just weeks away with a July release date. Almost all UK banks have signed up to it (with the exception of Barclays), together with some big name retailers including Costa Coffee and Boots. Find out what you need to know about Apple Pay in our three minute guide below:

What exactly is Apple Pay?

Apple Pay will allow owners of an Apple Watch or iPhone 7 to pay for goods by touching the device on contactless pads. It’s essentially the same set up as wireless payment cards – now you just won’t have to pull out your wallet.

How secure is it?

The Apple Pay system works by granting a one-off pay token to the retailer for each transaction. This means bank account details aren’t passed acrosss o it can’t be hijacked by hackers. However, it may be worth holding off an extra couple of weeks after the system goes live in case there are any security holes.

Is there a transaction limit?

Like contactless cards, it’s expected most retailers will enforce a £20 cap. However, this is quickly set to increase to £30 by September. This means you can use Apple Pay for small purchases, useful when you’re just buying a coffee or picking up groceries.

Will I have to pay extra to use Apple Pay?

No, like credit cards and debit cards the transaction fees are covered by the retailer. However, some retailers may charge a small fee for payments under £5 – just like they currently do for credit/debit cards.

Can I use it to pay for anything else?

Apple Pay will enable you to make payments online via fingerprint technology. You’ll also be able to use it for other contactless payments, such as Tube or bus journeys.

Anything else I should know?

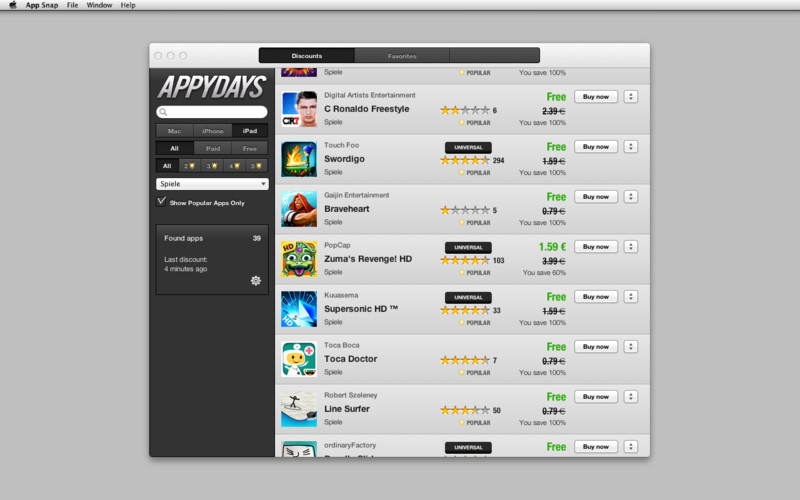

Samsung is expected to launch a rival service in the UK later this year, so don’t ditch your Android just yet if the sole reason is for contactless payments.